MONEY AND ACHIEVEMENT

In teaching your children how to value and handle money, you’ll struggle with the issues of allowances, earning money through chores, and even how you permit them to use monetary gifts given to them by grandparents. Your own value system will, of course, guide you in making final decisions, but keep in mind the goal of teaching your children about money management. It’s also at least as important to teach your children the three W’s: the principle of how to work and wait for the things they wish for. Children who learn to delay gratification receive some lifelong advantages.

In teaching your children how to value and handle money, you’ll struggle with the issues of allowances, earning money through chores, and even how you permit them to use monetary gifts given to them by grandparents. Your own value system will, of course, guide you in making final decisions, but keep in mind the goal of teaching your children about money management. It’s also at least as important to teach your children the three W’s: the principle of how to work and wait for the things they wish for. Children who learn to delay gratification receive some lifelong advantages.

THE EARLY YEARS

Establishing small allowances by the time your children reach kindergarten or first grade are mostly helpful for teaching kids about counting money and making change. However, even a 10- or 25-cent weekly allowance can be useful for a treat or can be deposited in a piggy bank. Actually, banks often encourage children to start their own accounts early.

Children of primary school age can help wash the car, weed the garden, or vacuum the living room. They can do some simple folding of laundry and will be delighted to accrue nickels, dimes, and quarters. Even pennies are valued by young children. They can count their savings and buy some small items.

Teach your children the three W’s:

the principle of how to work and

wait for the things they wish for.

Be sure not to pay children for all their chores. Making their beds, setting the table, and picking up toys or laundry in their room continue to fit under regular household responsibilities that shouldn’t be compensated. If you pay children for all their chores, you’ll soon hear them ask for money for everything they do.

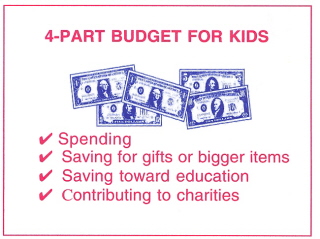

Gradually increasing allowances with age will permit you to continue to emphasize saving, waiting, and spending appropriately. Dividing allowances and earnings into three or four parts often works well. For example, the first part can be spent, the second saved for special purchases or gifts for family and friends, and the third can go to a college fund. Parents can also encourage a fourthCcontributions to a charity.

Gradually increasing allowances with age will permit you to continue to emphasize saving, waiting, and spending appropriately. Dividing allowances and earnings into three or four parts often works well. For example, the first part can be spent, the second saved for special purchases or gifts for family and friends, and the third can go to a college fund. Parents can also encourage a fourthCcontributions to a charity.

TWEENS ENJOY EARNING MONEY

By the middle school years, preadolescents can devise a great many ways to spend “their” money. It may be time to remind them that it’s only partially theirs, and, as their parents, you can determine the limits to their spending. Some music, movies, and videos can still be off limits even if they’re using their own money to buy them. Reserve your right to give the final OK, but remember that they need to have some freedom to make choices and even to make some mistakes.

There are many ways for middle school students to earn money, including mowing lawns, babysitting, or gardening for neighbors. However, even when the money comes from outside sources, your bywords can still remain “freedom within limits.” When your children remind you that they have their own money, you might tactfully point out that you don’t charge them for rent or food, and as parents you reserve the final responsibility that goes with occasionally sayingTEENAGER TIPS

Teenage money matters are much more complex. Providing spending money and clothing allowances may continue to be appropriate. If you prefer not to use a clothing allowance approach, at least give your adolescents some “not too exceed” guidelines for their shopping trips. They may prefer to do some shopping on their own or with their friends, which can be healthy for their sense of growing up and becoming independent. Some teenagers can even be trusted to use their parents’ credit cards and charge accounts carefully. If teenagers feel you trust them, a better parent-child alliance can be established. Of course, trust involving money depends on general trust in the family and should be explored gradually and carefully with your teenager.

If your teenagers work part-time or during the summers, they may earn paychecks that can disappear more quickly than they’re earned. Your guidance will be helpful. If you’ve taught them three-or four-part distribution of their earnings earlier, they'll handle larger amounts of money appropriately. However, instant gra-tification can be tempting to all of us, so teaching teen-agers the wish, work, and wait principle of delayed gratification applies much more to their hundreds of dollars in paychecks than it did to their 25-cent allow-ances of their earlier years.

If your teenagers work part-time or during the summers, they may earn paychecks that can disappear more quickly than they’re earned. Your guidance will be helpful. If you’ve taught them three-or four-part distribution of their earnings earlier, they'll handle larger amounts of money appropriately. However, instant gra-tification can be tempting to all of us, so teaching teen-agers the wish, work, and wait principle of delayed gratification applies much more to their hundreds of dollars in paychecks than it did to their 25-cent allow-ances of their earlier years.

Grandparents’ monetary gifts, whether they’re given to your children at ages two or twelve or twenty, should be carefully discussed with grandparents first. They may have some specific intentions or may wish to leave it up to your guidelines. If grandparents allow it, spending some and saving some continues to make good sense for your children regardless of age. Do include grandparents’ gifts in kids’ education funds. Children who save toward college are more likely to expect to achieve a higher education.

MONEY AND ACHIEVEMENT

What does money management have to do with achievement? In addition to teaching some basic mathematics, learning about money teaches children about the concept of delayed gratification or how to wait and work for what they want. Research tells us that children who can learn to delay gratification are much more likely to be life-long achievers. Children who believe they must have instant gratification can’t wait long enough to work at something. Thus, they’re less likely to achieve in school or in life.

What does money management have to do with achievement? In addition to teaching some basic mathematics, learning about money teaches children about the concept of delayed gratification or how to wait and work for what they want. Research tells us that children who can learn to delay gratification are much more likely to be life-long achievers. Children who believe they must have instant gratification can’t wait long enough to work at something. Thus, they’re less likely to achieve in school or in life.

©2010 by Sylvia B. Rimm. All rights reserved. This publication, or parts thereof, may not be reproduced in any form without written permission of the author.